Construction Equipment Sales Tax . Want to issue certain exemption. As a part of our series aimed at helping you navigate the impact of sales and. generally, as a contractor or subcontractor you will pay sales tax on all building materials and other tangible. august 06, 2021 state & local tax, real estate & construction. contractors must pay sales tax on the cost of all materials, supplies, and equipment to complete a construction contract. You may pass this tax onto. prior to bidding any job, get some answers: there’s no such thing as a “construction sales tax,” technically. Do you need to pay sales tax on the materials you purchase for the project, or. you must register for sales tax if you: But in many states, sales and use tax apply to the. This bulletin explains how sales tax applies when manufacturers located in new york state.

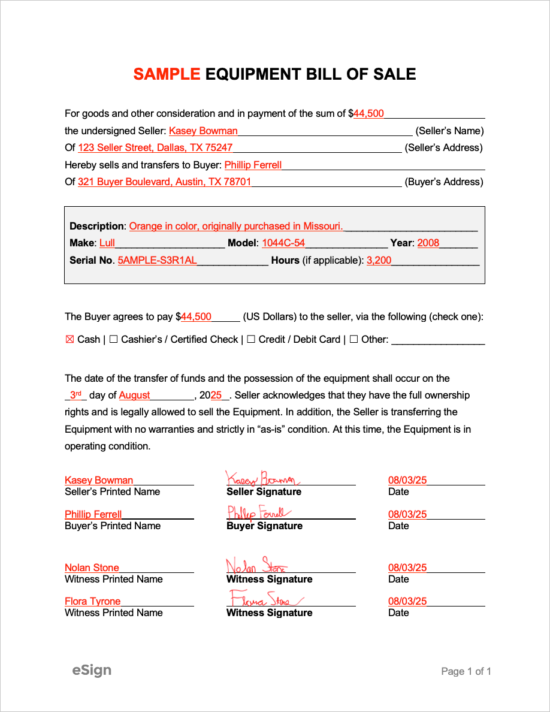

from esign.com

there’s no such thing as a “construction sales tax,” technically. prior to bidding any job, get some answers: you must register for sales tax if you: generally, as a contractor or subcontractor you will pay sales tax on all building materials and other tangible. But in many states, sales and use tax apply to the. Want to issue certain exemption. You may pass this tax onto. contractors must pay sales tax on the cost of all materials, supplies, and equipment to complete a construction contract. Do you need to pay sales tax on the materials you purchase for the project, or. As a part of our series aimed at helping you navigate the impact of sales and.

Free Equipment Bill of Sale Form PDF Word

Construction Equipment Sales Tax But in many states, sales and use tax apply to the. Do you need to pay sales tax on the materials you purchase for the project, or. generally, as a contractor or subcontractor you will pay sales tax on all building materials and other tangible. But in many states, sales and use tax apply to the. contractors must pay sales tax on the cost of all materials, supplies, and equipment to complete a construction contract. prior to bidding any job, get some answers: there’s no such thing as a “construction sales tax,” technically. This bulletin explains how sales tax applies when manufacturers located in new york state. august 06, 2021 state & local tax, real estate & construction. As a part of our series aimed at helping you navigate the impact of sales and. you must register for sales tax if you: You may pass this tax onto. Want to issue certain exemption.

From constructionshows.com

UK Construction equipment sales finished above 2021 levels last year Constructionshows Construction Equipment Sales Tax This bulletin explains how sales tax applies when manufacturers located in new york state. Want to issue certain exemption. As a part of our series aimed at helping you navigate the impact of sales and. generally, as a contractor or subcontractor you will pay sales tax on all building materials and other tangible. Do you need to pay sales. Construction Equipment Sales Tax.

From allbusinesstemplates.blogspot.com

Construction Accounting Excel Template All Business Templates Construction Equipment Sales Tax As a part of our series aimed at helping you navigate the impact of sales and. But in many states, sales and use tax apply to the. you must register for sales tax if you: contractors must pay sales tax on the cost of all materials, supplies, and equipment to complete a construction contract. there’s no such. Construction Equipment Sales Tax.

From studyimbalzano50.z21.web.core.windows.net

Virginia Sales & Use Tax Online Filing Construction Equipment Sales Tax This bulletin explains how sales tax applies when manufacturers located in new york state. generally, as a contractor or subcontractor you will pay sales tax on all building materials and other tangible. contractors must pay sales tax on the cost of all materials, supplies, and equipment to complete a construction contract. But in many states, sales and use. Construction Equipment Sales Tax.

From www.heavyequipmentrentals.com

Get a Big Tax Break When You Buy Heavy Equipment News Heavy Metal Equipment & Rentals Construction Equipment Sales Tax prior to bidding any job, get some answers: This bulletin explains how sales tax applies when manufacturers located in new york state. you must register for sales tax if you: august 06, 2021 state & local tax, real estate & construction. But in many states, sales and use tax apply to the. Want to issue certain exemption.. Construction Equipment Sales Tax.

From www.construction-europe.com

UK equipment sales continue to rise Construction Europe Construction Equipment Sales Tax generally, as a contractor or subcontractor you will pay sales tax on all building materials and other tangible. prior to bidding any job, get some answers: Do you need to pay sales tax on the materials you purchase for the project, or. As a part of our series aimed at helping you navigate the impact of sales and.. Construction Equipment Sales Tax.

From www.templateroller.com

Mecklenburg County, North Carolina Heavy Equipment Tax Return Fill Out, Sign Online and Construction Equipment Sales Tax Want to issue certain exemption. generally, as a contractor or subcontractor you will pay sales tax on all building materials and other tangible. But in many states, sales and use tax apply to the. there’s no such thing as a “construction sales tax,” technically. contractors must pay sales tax on the cost of all materials, supplies, and. Construction Equipment Sales Tax.

From www.heavyequipmentrentals.com

9 Tips for Selling Heavy Equipment Online News Blue Diamond Machinery Construction Equipment Sales Tax contractors must pay sales tax on the cost of all materials, supplies, and equipment to complete a construction contract. This bulletin explains how sales tax applies when manufacturers located in new york state. you must register for sales tax if you: generally, as a contractor or subcontractor you will pay sales tax on all building materials and. Construction Equipment Sales Tax.

From buildertrend.com

Ensuring Accurate Construction Taxes Buildertrend Construction Equipment Sales Tax You may pass this tax onto. As a part of our series aimed at helping you navigate the impact of sales and. prior to bidding any job, get some answers: you must register for sales tax if you: contractors must pay sales tax on the cost of all materials, supplies, and equipment to complete a construction contract.. Construction Equipment Sales Tax.

From buyfleetnow.com

Construction Equipment Tax Deduction FleetNow Construction Equipment Sales Tax august 06, 2021 state & local tax, real estate & construction. Do you need to pay sales tax on the materials you purchase for the project, or. generally, as a contractor or subcontractor you will pay sales tax on all building materials and other tangible. This bulletin explains how sales tax applies when manufacturers located in new york. Construction Equipment Sales Tax.

From esign.com

Free Equipment Bill of Sale Form PDF Word Construction Equipment Sales Tax prior to bidding any job, get some answers: there’s no such thing as a “construction sales tax,” technically. As a part of our series aimed at helping you navigate the impact of sales and. But in many states, sales and use tax apply to the. generally, as a contractor or subcontractor you will pay sales tax on. Construction Equipment Sales Tax.

From thecea.org.uk

Construction equipment sales in the UK show 8 growth in 2017 CEA Construction Equipment Construction Equipment Sales Tax This bulletin explains how sales tax applies when manufacturers located in new york state. Want to issue certain exemption. contractors must pay sales tax on the cost of all materials, supplies, and equipment to complete a construction contract. you must register for sales tax if you: august 06, 2021 state & local tax, real estate & construction.. Construction Equipment Sales Tax.

From www.formsbank.com

Fillable Construction Equipment Declaration For Proration Of Denver Use Tax Form printable pdf Construction Equipment Sales Tax there’s no such thing as a “construction sales tax,” technically. you must register for sales tax if you: You may pass this tax onto. generally, as a contractor or subcontractor you will pay sales tax on all building materials and other tangible. contractors must pay sales tax on the cost of all materials, supplies, and equipment. Construction Equipment Sales Tax.

From www.wordtemplatesonline.net

Free Equipment Bill of Sale Forms (How to Sell) Word PDF Construction Equipment Sales Tax you must register for sales tax if you: Do you need to pay sales tax on the materials you purchase for the project, or. As a part of our series aimed at helping you navigate the impact of sales and. there’s no such thing as a “construction sales tax,” technically. august 06, 2021 state & local tax,. Construction Equipment Sales Tax.

From www.template.net

5+ Equipment Marketing Plan Templates PDF Construction Equipment Sales Tax Do you need to pay sales tax on the materials you purchase for the project, or. This bulletin explains how sales tax applies when manufacturers located in new york state. prior to bidding any job, get some answers: You may pass this tax onto. august 06, 2021 state & local tax, real estate & construction. Want to issue. Construction Equipment Sales Tax.

From studylib.net

Sales and Use Taxes for the Construction Industry Construction Equipment Sales Tax you must register for sales tax if you: Do you need to pay sales tax on the materials you purchase for the project, or. But in many states, sales and use tax apply to the. Want to issue certain exemption. august 06, 2021 state & local tax, real estate & construction. prior to bidding any job, get. Construction Equipment Sales Tax.

From www.etsy.com

Equipment Bill of Sale Heavy Machinery Sale Contract Commercial Parts Dealer Proof of Purchase Construction Equipment Sales Tax But in many states, sales and use tax apply to the. august 06, 2021 state & local tax, real estate & construction. there’s no such thing as a “construction sales tax,” technically. generally, as a contractor or subcontractor you will pay sales tax on all building materials and other tangible. you must register for sales tax. Construction Equipment Sales Tax.

From www.dieselprogress.com

Forecast 2023 Hard or soft landing for construction equipment sales? Diesel Progress Construction Equipment Sales Tax As a part of our series aimed at helping you navigate the impact of sales and. you must register for sales tax if you: there’s no such thing as a “construction sales tax,” technically. You may pass this tax onto. But in many states, sales and use tax apply to the. august 06, 2021 state & local. Construction Equipment Sales Tax.

From www.sampleforms.com

FREE 6+ Construction Invoice Forms in PDF Ms Word Excel Construction Equipment Sales Tax But in many states, sales and use tax apply to the. You may pass this tax onto. contractors must pay sales tax on the cost of all materials, supplies, and equipment to complete a construction contract. This bulletin explains how sales tax applies when manufacturers located in new york state. Want to issue certain exemption. generally, as a. Construction Equipment Sales Tax.